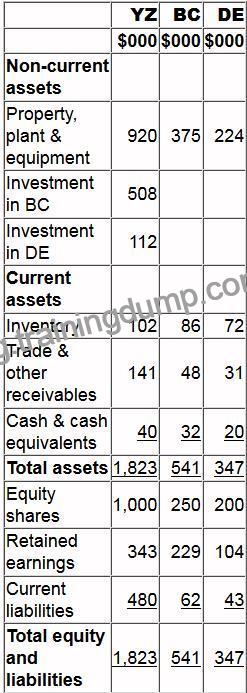

NO.124 Statements of financial position for YZ, BC and DE at 31 March 20X2 include the following balances:

YZ purchased 90% of BC’s equity shares for $508,000 on 1 January 20X2. On 1 January 20X2 BC’s retained earnings were $183,000. YZ uses the proportion of net assets method to value non-controlling interest at acquisition.

YZ purchased 30% of DE’s equity shares on 1 April 20X1 for $112,000. DE’s retained earnings at 1 April

20X1 were $88,000.

On 1 February 20X2 YZ sold goods to BC for $28,000 at a mark up of 25% on cost. All the goods were still in BC’s inventory at 31 March 20X2.

Calculate the value of the investment in associate to be recognised in the consolidated statement of financial position at 31 March 20X2.

Give your answer to nearest whole $.