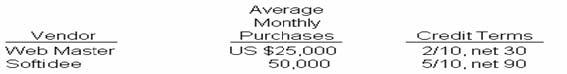

NO.33 Assuming a 360-day year and that CyberAge continues paying on the last day of the credit period, the entity’s weighted-average annual interest rate for trade credit ignoring the effects of compounding) for these two vendors is:

If the entity pays Web […Taster within 10 days, it will save US $500 $25,000 2%). Thus, the entity is effectively paying US $500 to retain US $24,500 $25,000 – $500) for 20 days 30 10). The annualized interest rate on this borrowing is 36.7346% [(US $500 + $24,500) x 360 days / 20 days)]. Similarly, the entity is, in effect, paying Softidee US $2,500 $50,000 5%) to hold US $47.500 $50,000 – $2,500) for 80 days 90 – 1 0). The annualized rate on this borrowing is 23.6842% [(US $2,501-1 – $47,500) 361 r days – 80 days)]. The average amount burrowed from Web Master is US $16,333 33 [$24,500 x 1 month x 20 days – 30 days)]. The average amount borrowed from web master is US $126,666.67 [$47,500 x 3 months x 80 days / 90 days)]. Thus, the weighted average of these two rates based on average borrowing is 25.2% [(US16,333,33 x 36.7346%) + ($126,666,67 x 23,6824%] / $16,333.33 + $126,666.67)]. This calculation however, understates the true cost of not taking the discount because it does not consider the effects of compound. CyberAge Outlet, a relatively new store, is a cafe that offers customers the opportunity to browse the Internet or play computer games at their tables while they drink coffee. The customer pays a fee based on the amount of time spent signed on to the computer. The store also sells books. tee-shirts, and computer accessories. CyberAge has been paying all of its bills on the last day of the payment period, thus forfeiting all supplier discounts. Shown below are data on CyberAge’s two major vendors, including average monthly purchases and credit terms.

Leave a Reply